|

At the recent Investment Advisory Board Meeting, Medina County Treasurer Burke reported that investment earnings for the County totaled $2,087,913 in 2022, up 61% from the previous year. Burke said the large increase of $795,112 was the result of a successful investment strategy implemented to take advantage of rising interest rates in the financial markets.

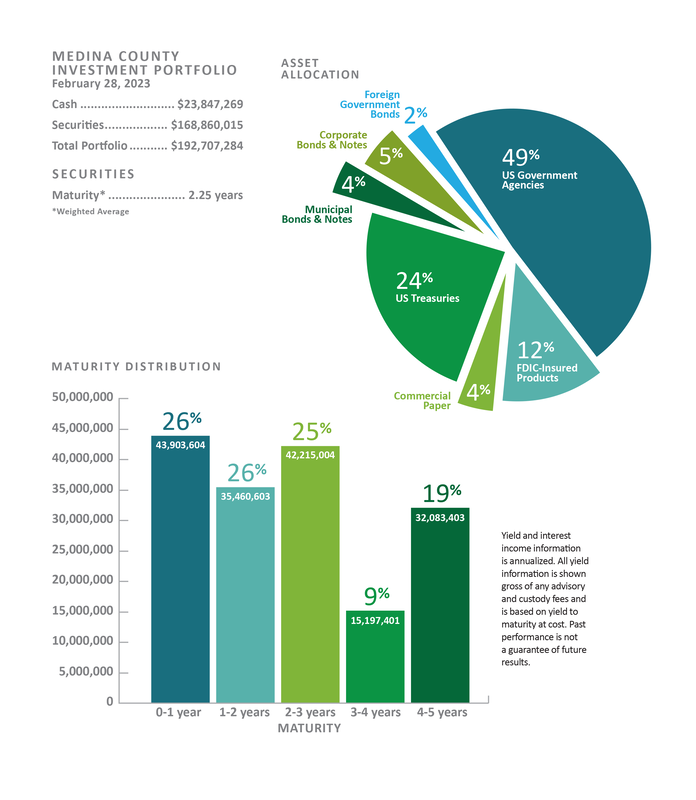

“This increase of investment revenue is extra income for the County which can be used by the Commissioners to help pay for services and operational costs of the County. This extra revenue source also helps to diminish the need for additional taxes,” noted Burke. At the beginning of 2022, interest earnings from the investment portfolio were projected to be $1,300,000 for the entire year. Because of the changes in the financial market Burke rebalanced the maturity of the investments in the County’s portfolio to take advantage of higher short-term rates. Burke said, “This investment strategy brought in an additional $800,000 by the end of the year”. Burke reported that the increase in interest rates over the last year was largely due to the Federal Reserve increasing their fund’s rate charged to banks. In 2022, the Fed increased their interest rate eight times from 0.25% to 4.5%. As a result, the cost of borrowing money from the banks dramatically increased. For example, home mortgage rates have more than doubled to over 6%. “These changes in the financial market provided opportunities to earn higher interest earnings on various investments according to their type and maturity,” he noted. As Treasurer, Burke oversees the County’s investment portfolio which currently has over $168 million invested. “We normally have about 120 to 170 different investments on any given day,” Burke explained. The largest investment allocation currently is 49% in US Government agencies such as Federal Farm Credit Bank, Federal National Mortgage Association, Sallie Mae Bank, and Federal Home Loan Mortgage Corp. The second largest investment of 24% is currently in U.S. Treasuries. To make those investments the Ohio Revised Code requires County Treasurers to take continuing education courses each year approved by the State of Ohio Treasurer and Auditor. Besides completing his annual hours of continuing education, Treasurer Burke has also earned other certifications such as the “Chancellor’s Certification for Public Administration” from IGO International Government Officials Association; “Financial Officer Certification” from NACTFO (National Association of Treasurers and Finance Officials); and numerous Professional Development Awards from the CTAO (County Treasurer’s Association of Ohio). “Continual learning is important for every public fund manager to safely invest public funds and get the highest yield possible,” stated Burke who also has a BA and a Master’s in business administration from Miami University. Treasurer Burke is chairman of the County Investment Advisory Board which meets quarterly to review the investment portfolio managed by the Treasurer. The other members of the Investment Advisory Board include the three County Commissioners and the County Clerk of Courts. PLEASE NOTE: The information contained in this article was not intended to be nor should be considered investment advice.

0 Comments

MEDINA COUNTY, OHIO – At the recent third quarter Investment Advisory Board Meeting, Medina County Treasurer John Burke reported that the County has earned $1,308,316 interest income from the investment portfolio that he administers. That is an income increase of 30% or $305,686 more than last year to date as of September. Burke said this large increase of interest earnings is a result of a successful investment strategy implemented to take advantage of rising interest rates. Burke reported that the financial market has seen interest rates increase this year, largely due to the Federal Reserve increasing their fund’s rate charged to banks from 1.0% to 3.25%. As a result, the cost of borrowing money from the banks has dramatically increased. For example, home mortgage rates have more than doubled. At the same time this has provided opportunities to earn higher interest earnings on various investments according to their type and maturity. At the beginning of 2022, interest earnings from the investment portfolio were projected to be $1,300,000 for the entire year. Because of the changes in the financial market Burke rebalanced the maturity of the investments in the County’s portfolio to take advantages of higher short-term rates. “We recalculated the expected interest income and updated the 2022 estimate, and now it is going to be closer to earnings of $2,000,000 for this year,” Burke said. This increase of investment revenue is extra income for the County that can be used by the Commissioners to help pay for services and the operational costs of the County. This extra revenue source also helps to diminishes the need for additional taxes according to Burke. As Treasurer, Burke oversees the County’s investment portfolio which currently has over $157 million invested. “We normally have about 100 to 120 different investments on any given day,” Burke explained. The largest investment allocation currently is 45% in US Government agencies such as Federal Farm Credit Bank, Federal National Mortgage Association, Sallie Mae Bank and Federal Home loan Mortgage Corp. To make those investments the Ohio Revised Code requires County Treasurers to take continuing education courses each year approved by the State of Ohio Treasurer and Auditor. Besides completing his annual hours of continuing education, Treasurer Burke has also earned other certifications such as the “Chancellor’s Certification for Public Administration” from the International Government Officials Association (IGO), the “Financial Officer Certification” from the National Association of Treasurer and Finance Officials (NACTFO), and numerous Professional Development Awards from the County Treasurer’s Association of Ohio (CTAO). “Continual learning is important for every public fund manager to safely invest public funds and get the highest yield possible” stated Burke who also has a BA and a master’s in business administration from Miami University. Treasurer Burke is chairman of the County Investment Advisory Board which meets quarterly to review the investment portfolio managed by the Treasurer. The other members of the Investment Advisory Board include the three County Commissioners and the County Clerk of Courts. PLEASE NOTE: The information contained in this article was not intended to be nor should be considered investment advice. MEDINA COUNTY, OHIO – “In these volatile economic times it is difficult to increase returns on investment portfolios. But we were able to do just that” Medina County Treasurer John Burke stated at the recent Medina County Investment Advisory Board meeting. Held quarterly, the Investment Advisory Board includes all three County Commissioners, the County Clerk of Courts and the County Treasurer as chairman.

At the meeting Treasurer Burke reviewed the County’s Investment portfolio. Year-to-date interest earnings through August 2016 were $589,606 compared to $495,020 last year – an increase of $94,586 or 19%. The projected interest income earnings were $880,000 for 2016. Treasurer Burke said that the investment portfolio, which currently is about $70 million, should make more than that estimate by the end of the year. This extra income for the County is placed in the General Fund to be used by the Commissioners for expenses and services provided to county residents. “Investment income is one way we can contribute to the County revenue and help pay for services that our residents have come to expect. It helps to keep the need for additional taxes low,” Burke said. Treasurer Burke reviewed $39 million of new investment purchases to the portfolio since last quarter. He explained that the market has drastically changed from last quarter. Nine-month to one-year investment interest rates have increased. In comparison, investors now have to go to a 3-year maturity in Government agency rates such as FHLB and FNMA to match the new short term rates. “Consequently,” Burke said “the current portfolio of about $70 million has been invested in shorter term investments. Our average weighted maturity is now 1.51 years.” He explained that to seek higher returns and to take advantage of current market trends the makeup of the portfolio has increased FDIC insured investments in the county’s portfolio to 37%, commercial paper to 33% and dropped U.S. agencies to 30%. County investments are governed by the Ohio Revised Code which does not allow investing of county funds in stocks or equities because of the risk involved in those types of investments. Interest bearings investments must have a five-year or less maturity. The portfolio is currently invested in about 72 different interest bearing securities. The County Treasurer also sends monthly reports reflecting the content of the investment portfolio to the members of the Investment Advisory Board and to the Treasurer of the State of Ohio. All county treasurers in Ohio are required to take continuing education courses each year approved by the State of Ohio Treasurer and Auditor. “This helps us keep up to date on market trends and changes in investment regulations” Burke explained. Economic conditions were also reviewed at the meeting. Treasurer Burke noted that the Federal Reserve has set a target rate of inflation at 2% and has indicated they will not increase their interest rate prior to the end of 2016 after the elections. Their last interest rate hike was in December of 2015. According to Meeder Investment Management of Dublin, Ohio, the probability of an interest rate hike by the Federal Reserve in the next year has increased from 30% to 70% since the end of June. This is another good reason to increase the short term investment holdings in the County’s portfolio. If you have any questions, please call the Medina County Treasurer’s office at 330.725.9748. Please Note: the information contained in this article was not intended to be nor should be considered investment advice. |

Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed