|

At the Tuesday, June 18 meeting of the Medina County Commissioners, County Treasurer John Burke announced a new convenient service for paying property taxes. He pointed out that the second half tax bills mailed last week include a QR code printed in the top right-hand corner which will help taxpayers more quickly access their tax information.

“Taxpayers can scan the QR code with the camera app on their smartphone, open it in a browser as prompted and be directly connected to the Treasurer’s website. The first pop-up page is to accept the terms of use for the website. Just click the “Accept” button and the next pop up is the search page for your tax bill," he explained. Taxpayers can search for their tax bill by using their name, address, or parcel number. Balance due and tax payments can be reviewed. Online payments can be made by electronic check ($1.50 bank/vendor fee) or by credit card, debit card, or PayPal. These add a 2.5% bank/vendor fee on the amount being paid. Burke reported that he only knows of 2 other counties in the State of Ohio that are currently using a QR code on their tax bills. “I think such innovative options improve our service to the taxpayers of Medina County – and that’s why we are here.” MEDINA COUNTY, OHIO – Medina County Treasurer John Burke has announced that 67,566 second half 2023 property tax bills have been mailed to county property owners. The official payment due date for these tax bills is July 12, 2024. The total dollar amount of real estate taxes billed for the second half is $213,498,838 — an increase of $13,550,231 over the same period last year, Treasurer Burke noted.

If property owners do not receive a tax bill in the mail, Treasurer Burke recommends calling his office at 330.725.9748 or accessing the Treasurer’s website at medinacountytreasurer.com to look up their tax bill. Just click “Search and Pay Taxes” in the left column to find the proper tax bill amount. Taxpayers can then print an official tax bill for paying by mail or in person. Taxpayers can also make a payment online and then print a receipt. Treasurer Burke noted. “Online tax payments are easy, safe, fast and convenient and we provide a variety of online payment options.” Taxpayers can pay by electronic check ($1.50 fee), credit card, PayPal account, or debit card. The vendor fees charged for each of these options are paid directly to the vendors. Medina County does not receive any part of the fees. You may also pay by phone with Visa, MasterCard or Discover credit cards, and e-check toll-free at 1.888.607.8389.* If you are paying by check, convenient 24-Hour Drive-Up Drop Boxes may be found at the following locations:

Payments may be made in person at the Treasurer’s office at 144 N. Broadway, Medina, from 8:00am to 4:30pm, Monday thru Friday. The office will be open until 6:00pm on the July 12th due date. You will need to present your entire tax bill at time of payment. Checks, cash, or credit cards (Visa, MasterCard, Discover, American Express) are accepted over the counter. * Tax payments which are mailed MUST be postmarked no later than the July 12th due date to avoid a 5% penalty; payments made after July 22nd will be assessed a 10% penalty. If you have any questions, please call the Medina County Treasurer’s office at 330.725.9748. * A convenience fee will be assessed by the vendor. Beginning May 1, 2024, Medina County Treasurer John Burke and Westfield Bank will once again be offering Fix-It Funds low-interest fixed rate home improvement loans to Medina County homeowners.

Westfield Bank has partnered with the Treasurer’s office since 2015 to offer these fixed rate loans at up to 2% below the bank’s current rate. Fix-It Funds loans can range from $5,000 to $50,000 and are given on a first-come, first-served basis until available funds are depleted. Almost all types of interior and exterior home improvements are eligible, including painting, wallpaper, lighting, flooring, plumbing, carpeting, furnaces, air conditioners, remodeling, additions, decks, window and door replacements, roofing, siding, gutters, driveways, patios, and sidewalks to name a few. There are only a few ineligible improvements such as swimming pools, satellite dishes, or hot tubs. Manufactured homes are not eligible for a Fix-It Funds loan. There is no income limit to qualify for these loans. You must be a Medina County resident; your home (1-4 family unit dwelling) must have a tax appraised value of $300,000 or less excluding land, according to the Medina County Auditor’s appraised value; and you cannot be delinquent on your real estate taxes. Homeowners have up to 18 months to complete the work for which the loan was granted. “Over 90% of the homes in Medina County may qualify,” Burke noted. “We currently have over $1 million in active Fix-It Funds loans with an average value of $17,166. Since its authorization by the County Commissioners in 2002, the Fix-It Funds program has provided over $15.7 million in low-interest home improvement loans to over 1,000 Medina County residents. “Homeowners all across Medina County have been helped by these loans,” said Treasurer Burke, noting that since the program’s inception, $2.8 million in loans have gone to homeowners in Brunswick; $1.6 million to Wadsworth; $3 million to Medina; and $8.3 million to residents in surrounding townships. “The market for home mortgage interest rates has averaged about 7% over the last two years. Equity line interest rates can be as high as 9%. As an alternative, the Fix-It Funds program’s fixed interest rate at up to 2% below the bank’s normal rates looks pretty good,” Burke said. This innovative and unique program has been given recognition by the national county elected officials’ organization IACREOT. Treasurer Burke has assisted the Treasurers of Stark and Portage counties to establish the same linked-deposit program. Only three other counties in Ohio offer similar programs. Interested homeowners can apply at two Westfield Bank locations: 4015 Medina Road on Route 18 in Medina, and Two Park Circle in Westfield Center, or contact the following Westfield Bank representatives: • Cheryl Murrin (NMLS#1365194), [email protected], 330.764.6091 • Michelle Evans (NMLS#1460020), [email protected], 330.661.6083 • Cindy Siepker (NMLS#2466577), [email protected], 330.661.6257 For more information, please call the Medina County Treasurer’s office at 330.725.9746, email [email protected], or search Fix-It Funds at www.medinacountytreasurer.com. Westfield Bank is member FDIC and equal opportunity lender. Medina County Treasurer John Burke announced at this week’s Medina County Commissioners meeting that he will prepare and file incorporation papers with the State of Ohio to create a Medina County Land Revitalization Corporation (LRC). Commonly referred to as a land bank or LRC, Ohio law allows land banks to acquire vacant and abandoned properties through tax foreclosure and donations and return it to productive use.

According to Burke, by establishing a land bank, Medina County can take advantage of new grants offered for the first time by the State of Ohio through the Welcome Home Ohio Program. This grant program allows land banks to purchase, rehab, or build qualifying residential properties for income eligible residents. Additionally, there are nonrefundable tax credits made to land banks and eligible developers for qualifying rehabs and new construction once the property is sold. Burke noted “this is an Ohio initiative offered only to land banks; that could mean about $1 million in grants for Medina County to improve our housing and allow more residents to access affordable housing.” Treasurer Burke explained he has closely observed the development of land banks in Ohio from inception in 2009 lead by former Cuyahoga County Treasurer Jim Rokakis and the County Treasurer’s Association of Ohio of which Burke is a member. “At that time, during the housing crisis, it provided a way to tackle the blight of abandoned and vacant homes in the big cities like Cleveland,” said Burke. Burke explained that Medina County has never had similar blight. Last year he reported that the County only had 37 Prosecutor initiated tax delinquent property foreclosures which were sold at sheriff sale. Those properties not sold at sheriff sale go to the County Auditor to sell for the amount of tax delinquency or less. Burke reported there were only 4 properties in the last County Auditor sale. “Consequently, there are few opportunities here in Medina County for a land bank to do their normal property acquisition demolition and resale. But now Ohio has new opportunities for land banks to invest in affordable housing which is needed according to a recent county-wide housing survey” Burke said. Treasurer Burke, Commissioner Steve Hambley, Economic Development Executive Director Bethany Dentler, and a task force of other community leaders have been meeting over the past few months to consider policies and a strategic plan for a land bank in Medina County. In response to Treasurer Burke’s announcement to proceed with filing for incorporation of a county land bank, the County Commissioners will hold a public hearing Tuesday March 5, 2024 at 9 am in the Commissioner’s meeting room on the 2nd floor of the county administration building. For questions or more information, call the Medina County Treasurer’s office at 330.725.9748 or 330.725.9745. MEDINA COUNTY, OHIO – Medina County Treasurer John Burke has announced that 78,960 first half 2023 property tax bills have been mailed to county property owners. The official payment due date for these tax bills is February 9, 2024. Treasurer Burke noted that the total amount of real estate taxes billed for the full year is $409,662,514 as compared to last year’s total of $392,954,351.

If taxpayers do not receive a tax bill in the mail, Treasurer Burke recommends calling his office at 330.725.9748 or accessing the Treasurer’s website (not the Auditor’s Website) at www.medinacountytreasurer.com to look up their tax bill. Just click “Search and Pay Taxes” in the left column to find the proper tax bill amount. Taxpayers can then print an official tax bill for paying by mail or in person. Taxpayers can also make payment online and then print a receipt. Treasurer Burke noted. “Online tax payments are easy, safe, fast and convenient and we provide a variety of online payment options.” Taxpayers can pay by electronic check ($1.50 fee), debit card (1.99% fee), credit card or PayPal account (2.5% fee). The vendor fees charged for these options are paid directly to the vendors. Medina County does not receive any part of the fees. In addition, through our website, PayPal Credit offers a “bill me later” option, which allows payment over 6 months with no interest charged. “We have seen some taxpayers take advantage of this opportunity to gain extra time to pay. This option allows them to meet the due date and avoid a 10% late payment charge,” said Treasurer Burke. More information is available on the PayPal website. This option is subject to prior credit approval. Vendor charges of 2.5% apply. You may also pay by phone with Visa, MasterCard or Discover credit cards toll-free at 1.888.607.8389 (2.5% fee). If you are paying by check, convenient 24-Hour Drive-Up Drop Boxes may be found at the following locations:

Payments may be made in person at the Treasurer’s office at 144 N. Broadway, Medina, from 8:00am to 4:30pm, Monday thru Friday. The office will be open until 6:00pm on the February 9th due date. You will need to present your entire tax bill at time of payment. Checks, cash, or credit cards – Visa, MasterCard, Discover, American Express – are accepted over the counter. A convenience fee will be assessed by the vendor. Tax payments which are mailed MUST be postmarked no later than the February 9th due date to avoid a 5% penalty; payments made after February 20th will be assessed a 10% penalty. If you have any questions, please call the Medina County Treasurer’s office at 330.725.9748. MEDINA COUNTY, OHIO – Medina County Treasurer John Burke has announced that 69,177 second half 2022 property tax bills have been mailed to county property owners. The official payment due date for these tax bills is July 14, 2023. Treasurer Burke noted that the total dollar amount of real estate taxes billed for the second half is $199,948,607.

If property owners do not receive a tax bill in the mail, Treasurer Burke recommends calling his office at 330.725.9748 or accessing the Treasurer’s website at www.medinacountytreasurer.com to look up their tax bill. Just click “Search and Pay Taxes” in the left column to find the proper tax bill amount. Taxpayers can then print an official tax bill for paying by mail or in person. Taxpayers can also make a payment online and then print a receipt. Treasurer Burke noted. “Online tax payments are easy, safe, fast and convenient and we provide a variety of online payment options.” Taxpayers can pay by electronic check ($2.00 fee), credit card or PayPal account (2.5% fee). The vendor fees charged for each of these options are paid directly to the vendors. Medina County does not receive any part of the fees. You may also pay by phone with Visa, MasterCard or Discover credit cards toll-free at 1.888.607.8389 (2.5% fee). If you are paying by check, convenient 24-Hour Drive-Up Drop Boxes may be found at the following locations: · Treasurer’s Office, County Administration Building, 144 North Broadway Street, Medina · Brunswick City Hall, 4095 Center Road, Brunswick · Lodi Library, 635 Wooster Street, Lodi · Wadsworth Municipal Building, 120 Maple Street, Wadsworth Make sure to include your tax bill stub with your check. Payments may be made in person at the Treasurer’s office at 144 N. Broadway, Medina, from 8:00am to 4:30pm, Monday thru Friday. The office will be open until 6:00pm on the July 14th due date. You will need to present your entire tax bill at time of payment. Checks, cash, or credit cards (Visa, MasterCard, Discover, American Express) are accepted over the counter. A convenience fee will be assessed by the vendor. Tax payments which are mailed MUST be postmarked no later than the July 14th due date to avoid a 5% penalty; payments made after July 24th will be assessed a 10% penalty. If you have any questions, please call the Medina County Treasurer’s office at 330.725.9748. MEDINA COUNTY, OHIO — Beginning May 1, 2023, Medina County Treasurer John Burke and Westfield Bank will once again be offering Fix-It Funds low-interest fixed rate home improvement loans to Medina County homeowners. These loans have a discounted fixed interest rate that is up to 2% below the bank’s current rate. “This can be a big savings to homeowners especially with the dramatic increase in interest rates over the past year,” noted Treasurer Burke.

Westfield Bank has partnered with the Treasurer’s office since 2015 to offer these fixed rate loans at up to 2% below the bank’s current rate. Loans can be from a minimum of $5,000 to a maximum of $50,000 and are given on a first-come, first-served basis until available funds are depleted. Almost all types of interior and exterior home improvements are eligible, including painting, wallpaper, lighting, flooring, plumbing, carpeting, furnaces, air conditioners, remodeling, additions, decks, window and door replacements, roofing, siding, gutters, driveways, patios, and sidewalks to name a few. There are only a few ineligible improvements such as swimming pools, satellite dishes, or hot tubs. Manufactured homes are not eligible for a Fix-It Funds loan. There is no income limit to qualify for these loans. You must be a Medina County resident; your home (1-4 family unit dwelling) must have a tax appraised value of $300,000 or less excluding land, according to the Medina County Auditor’s appraised value; and you cannot be delinquent on your real estate taxes. Homeowners have up to 18 months to complete the work for which the loan was granted. Since its authorization by the County Commissioners in 2002, the Fix-It Funds program has provided over $15.1 million in low-interest home improvement loans to over 1,000 Medina County residents. “Homeowners all across Medina County have been helped by these loans,” said Treasurer Burke, noting that since the program’s inception, $2.7 million in loans have gone to homeowners in Brunswick, $1.6 million to Wadsworth, $2.9 million to Medina, and $8.2 million to residents in surrounding townships. “Since we raised the home value limit to $300,000 last year, over 90% of the homes in Medina County may qualify for a Fix-It Funds loan,” he stated. In his 2022 annual report on Fix-It Funds to the Medina County Commissioners, Burke reported that the average loan size was $21,728. Burke related that last year the lingering effects of the COVID-19 pandemic had people spending more time at home, which led homeowners to take on more home improvement projects. But we also saw a dramatic rise in interest rates last year. Home mortgage interest rates are over 6% and some home equity loans are charging 8 to 9%. “Those high interest rates make our discounted Fix-It Fund loans look pretty good,” Burke said. This innovative and unique program has been given national recognition, earning the Eagle Award for best practices by the national county elected officials’ organization IACREOT. Treasurer Burke has assisted the Treasurers of Stark and Portage counties to establish the same linked-deposit program. Only three other counties in Ohio offer similar programs. Qualified homeowners interested in low-interest improvement loans can apply at two Westfield Bank locations: 4015 Medina Road on Route 18 in Medina, and Two Park Circle in Westfield Center, or contact the following Westfield Bank representatives: Cheryl Murrin (NMLS#1365194) at 330.764.6091, [email protected] Rachel Mlynczak (NMLS#244675) at 330.764.6080, [email protected] Michelle Evans (NMLS#1460020) at 330.661.6083, [email protected] Westfield Bank is member FDIC and equal opportunity lender. For more information, please call the Medina County Treasurer’s office at 330.725.9746, email [email protected], or search Fix-It Funds at www.medinacountytreasurer.com. At the recent Investment Advisory Board Meeting, Medina County Treasurer Burke reported that investment earnings for the County totaled $2,087,913 in 2022, up 61% from the previous year. Burke said the large increase of $795,112 was the result of a successful investment strategy implemented to take advantage of rising interest rates in the financial markets.

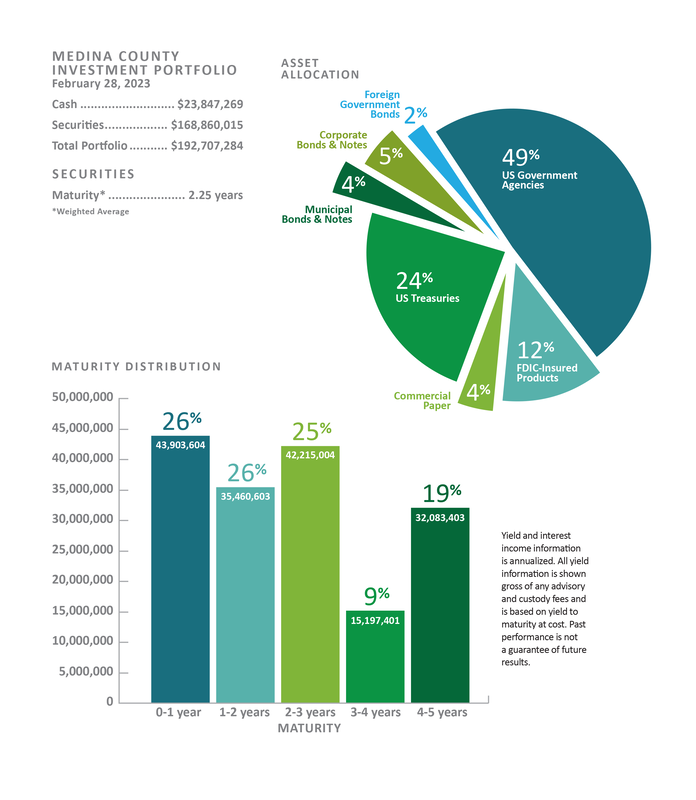

“This increase of investment revenue is extra income for the County which can be used by the Commissioners to help pay for services and operational costs of the County. This extra revenue source also helps to diminish the need for additional taxes,” noted Burke. At the beginning of 2022, interest earnings from the investment portfolio were projected to be $1,300,000 for the entire year. Because of the changes in the financial market Burke rebalanced the maturity of the investments in the County’s portfolio to take advantage of higher short-term rates. Burke said, “This investment strategy brought in an additional $800,000 by the end of the year”. Burke reported that the increase in interest rates over the last year was largely due to the Federal Reserve increasing their fund’s rate charged to banks. In 2022, the Fed increased their interest rate eight times from 0.25% to 4.5%. As a result, the cost of borrowing money from the banks dramatically increased. For example, home mortgage rates have more than doubled to over 6%. “These changes in the financial market provided opportunities to earn higher interest earnings on various investments according to their type and maturity,” he noted. As Treasurer, Burke oversees the County’s investment portfolio which currently has over $168 million invested. “We normally have about 120 to 170 different investments on any given day,” Burke explained. The largest investment allocation currently is 49% in US Government agencies such as Federal Farm Credit Bank, Federal National Mortgage Association, Sallie Mae Bank, and Federal Home Loan Mortgage Corp. The second largest investment of 24% is currently in U.S. Treasuries. To make those investments the Ohio Revised Code requires County Treasurers to take continuing education courses each year approved by the State of Ohio Treasurer and Auditor. Besides completing his annual hours of continuing education, Treasurer Burke has also earned other certifications such as the “Chancellor’s Certification for Public Administration” from IGO International Government Officials Association; “Financial Officer Certification” from NACTFO (National Association of Treasurers and Finance Officials); and numerous Professional Development Awards from the CTAO (County Treasurer’s Association of Ohio). “Continual learning is important for every public fund manager to safely invest public funds and get the highest yield possible,” stated Burke who also has a BA and a Master’s in business administration from Miami University. Treasurer Burke is chairman of the County Investment Advisory Board which meets quarterly to review the investment portfolio managed by the Treasurer. The other members of the Investment Advisory Board include the three County Commissioners and the County Clerk of Courts. PLEASE NOTE: The information contained in this article was not intended to be nor should be considered investment advice. Medina County Treasurer John Burke has announced that 80,584 first half 2022 property tax bills have been mailed to county property owners. The official payment due date for these tax bills is February 10, 2023. Treasurer Burke noted that the total amount of real estate taxes billed for the full year is $392,954,351 as compared to last year’s total of $354,316,439. This year’s billed real estate taxes were based on new values placed on properties by the County Auditor as part of his triennial reappraisal update.

If taxpayers do not receive a tax bill in the mail, Treasurer Burke recommends calling his office at 330.725.9748 or accessing the Treasurer’s website (not the Auditor’s Website) at www.medinacountytreasurer.com to look up their tax bill. Just click “Search and Pay Taxes” in the left column to find the proper tax bill amount. Taxpayers can then print an official tax bill for paying by mail or in person. Taxpayers can also make payment online and then print a receipt. Treasurer Burke noted. “Online tax payments are easy, safe, fast and convenient and we provide a variety of online payment options.” Taxpayers can pay by electronic check ($1.50 fee), credit card or PayPal account (2.5% fee). The vendor fees charged for these options are paid directly to the vendors. Medina County does not receive any part of the fees. In addition, through our website, PayPal Credit offers a “bill me later” option, which allows payment over 6 months with no interest charged. “We have seen some taxpayers take advantage of this opportunity to gain extra time to pay. This option allows them to meet the due date and avoid a 10% late payment charge,” said Treasurer Burke. More information is available on the PayPal website. This option is subject to prior credit approval. Vendor charges of 2.5% apply. You may also pay by phone with Visa, MasterCard or Discover credit cards toll-free at 1.888.607.8389 (2.5% fee). If you are paying by check, convenient 24-Hour Drive-Up Drop Boxes may be found at the following locations: · Treasurer’s Office, County Administration Building, 144 North Broadway Street, Medina · Brunswick City Hall, 4095 Center Road, Brunswick · Lodi Library, 635 Wooster Street, Lodi · Wadsworth Municipal Building, 120 Maple Street, Wadsworth Make sure to include your tax bill stub with your check. Payments may be made in person at the Treasurer’s office at 144 N. Broadway, Medina, from 8:00am to 4:30pm, Monday thru Friday. The office will be open until 6:00pm on the February 10th due date. You will need to present your entire tax bill at time of payment. Checks, cash, or credit cards – Visa, MasterCard, Discover, American Express – are accepted over the counter. A convenience fee will be assessed by the vendor. Tax payments which are mailed MUST be postmarked no later than the February 10th due date to avoid a 5% penalty; payments made after February 10th will be assessed a 10% penalty. If you have any questions, please call the Medina County Treasurer’s office at 330.725.9748. MEDINA COUNTY, OHIO – At the recent third quarter Investment Advisory Board Meeting, Medina County Treasurer John Burke reported that the County has earned $1,308,316 interest income from the investment portfolio that he administers. That is an income increase of 30% or $305,686 more than last year to date as of September. Burke said this large increase of interest earnings is a result of a successful investment strategy implemented to take advantage of rising interest rates. Burke reported that the financial market has seen interest rates increase this year, largely due to the Federal Reserve increasing their fund’s rate charged to banks from 1.0% to 3.25%. As a result, the cost of borrowing money from the banks has dramatically increased. For example, home mortgage rates have more than doubled. At the same time this has provided opportunities to earn higher interest earnings on various investments according to their type and maturity. At the beginning of 2022, interest earnings from the investment portfolio were projected to be $1,300,000 for the entire year. Because of the changes in the financial market Burke rebalanced the maturity of the investments in the County’s portfolio to take advantages of higher short-term rates. “We recalculated the expected interest income and updated the 2022 estimate, and now it is going to be closer to earnings of $2,000,000 for this year,” Burke said. This increase of investment revenue is extra income for the County that can be used by the Commissioners to help pay for services and the operational costs of the County. This extra revenue source also helps to diminishes the need for additional taxes according to Burke. As Treasurer, Burke oversees the County’s investment portfolio which currently has over $157 million invested. “We normally have about 100 to 120 different investments on any given day,” Burke explained. The largest investment allocation currently is 45% in US Government agencies such as Federal Farm Credit Bank, Federal National Mortgage Association, Sallie Mae Bank and Federal Home loan Mortgage Corp. To make those investments the Ohio Revised Code requires County Treasurers to take continuing education courses each year approved by the State of Ohio Treasurer and Auditor. Besides completing his annual hours of continuing education, Treasurer Burke has also earned other certifications such as the “Chancellor’s Certification for Public Administration” from the International Government Officials Association (IGO), the “Financial Officer Certification” from the National Association of Treasurer and Finance Officials (NACTFO), and numerous Professional Development Awards from the County Treasurer’s Association of Ohio (CTAO). “Continual learning is important for every public fund manager to safely invest public funds and get the highest yield possible” stated Burke who also has a BA and a master’s in business administration from Miami University. Treasurer Burke is chairman of the County Investment Advisory Board which meets quarterly to review the investment portfolio managed by the Treasurer. The other members of the Investment Advisory Board include the three County Commissioners and the County Clerk of Courts. PLEASE NOTE: The information contained in this article was not intended to be nor should be considered investment advice. |

Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed